Business travel is essential to grow professional connections, attend industry events, and find new business opportunities. That said, Travel and Expenses (T&E) monitoring can be challenging.

It’s important for auditors to ensure approved suppliers are being used to book travel as well as enforcing travel expense categories and limitations.

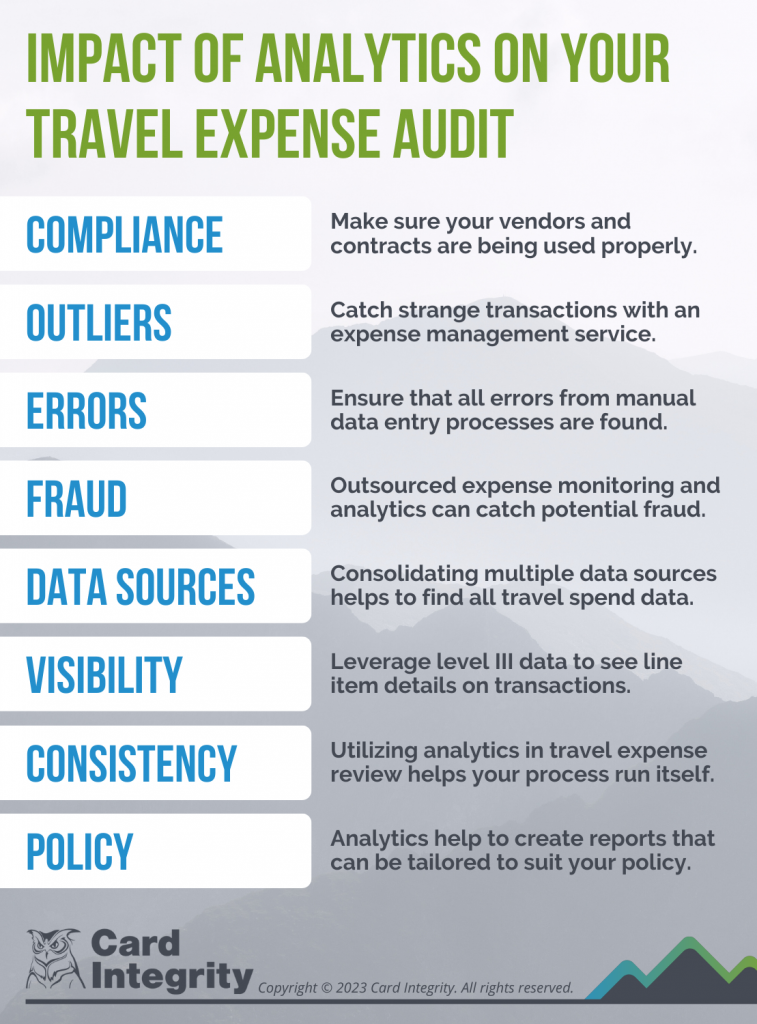

Whether you’re in a busy travel season or simply want to strengthen internal controls to eliminate fraud and achieve compliance, auditing expenses with analytics is a process well worth implementing.

Here are 9 specific reasons to audit travel expenses with analytics.

1. Ensure Vendor and Contract Compliance

You worked hard to establish vendor contracts and ensure compliance. Still, some purchases are bound to fall through the cracks. Sometimes this can be due to miscommunication or perhaps an employee doesn’t understand which supplier to use and why.

Nevertheless, purchases with non-contract vendors can cost unnecessary money if there are savings built into the contract agreement. Monitoring travel expenses with analytics can help you uncover specific transactions that don’t utilize approved suppliers.

From there, you can start to correct employees and invite them to train on the best practices for compliant travel spending.

2. Pick Up More Outliers

Being able to audit travel expenses with analytics and data will help you pick up on more outliers quicker since you’ll have a full view of the spend.

Expenses management services use automation and advanced methods to track 100% of the transaction data rather than just taking a sampling. That way you leave no stone unturned.

3. Uncover Questionable Expenses

If you’re wondering what type of transactions are hiding in your T&E spend data, you’re not alone. From split transactions to extended hotel stays and unnecessary airport purchases, running an analytics report on employees’ T&E expenses can be extremely eye-opening.

This is actually the best way to catch rogue or maverick spending so you can act quickly and prevent bigger issues like long-term fraud.

4. Find Errors in Manual Processes

When you audit travel expenses with the help of data analytics, you may find errors in manual processes. It never hurts to update your actual processes and determine where some improvements can be made.

One key benefit of data analytics is that it can easily identify duplicate payments, especially across different forms of payment. This is essential if more than one department is handling travel costs.

No matter how they’re occurring, duplicate payments are an unwanted issue and it’s important to clear up the cause of this as soon as possible to improve cash flow.

5. Detect Potential Fraudulent Activity

If fraudulent or questionable travel purchases have a big red flag next to them during your audit, they will be hard to miss. This is exactly what you can expect when you implement data analytics and machine learning systems.

When you outsource expense monitoring and data analytics, you can use technology for a variety of purposes. This includes pinpointing which specific purchases indicate fraud or misuse, overspending, as well as narrowing down ongoing spending trends to watch out for such as gift card purchases or even travel refunds.

6. Consolidate Multiple Sources of Data

Travel cards don’t always cover all travel expenses. Depending on your organization and card program, auditors may need to review transactions from multiple payment sources.

Consider using data analytics to bring multiple sources of data together for a better understanding of the overall spend for certain categories.

7. Increase Visibility For Specific Transactions

Sometimes it’s hard to validate the detailed transaction information such as the specific items that were purchased. If an employee does not submit a detailed receipt or business reason, this might raise some flags.

This can require extra time and energy on behalf of the auditor trying to track down the expense. An alternative option is to use level III data by category or supplier to increase visibility for your transactions.

Level III data includes line-item details about card purchases including the item code, quantity, supplier, and other information. Accessing level III data through data analytics can help auditors tighten up spend controls and better validate certain travel purchases.

8. Consistent Tracking and Auditing

Another simple but often overlooked benefit of being able to audit travel expenses with analytics is a consistent and more sustainable process each cycle. The volume of travel purchases may vary depending on when events and meetings are taking place as well as busier vs. slower travel seasons.

Regardless, integrating data analytics through an expense monitoring firm is a great way to let the process run itself. Each month you’ll receive consistent insights making it easier to keep up with verification procedures and other auditing requirements.

9. Customized Reporting Based on Your Company’s Policies

Using data analytics to audit travel expenses doesn’t just mean you’ll receive a lump sum of data to sort through each month. When you use a third-party expense review service like Card Integrity, it actually means the opposite.

Card Integrity provides monthly reports that are customized based on your company’s policies and areas of interest. We provide analytics and reporting by pairing our tools with a data analytics expert to deliver actionable insights.

These insights will assist an expense audit whether you want to track expenses for an individual supplier, expense category, specific cardholder, or all of the above.

How Can Data Analytics Work For Your Company’s Expense Audit?

Whether you’re looking for cost savings, card program growth, or to optimize supplier partnerships, using analytics to audit travel expenses can help.

With T&E spending, it’s not uncommon to uncover non-compliant purchases, misuse, and even fraud. The solutions at Card Integrity can help you manage your audit with ease.

In fact, our DataWISE expense monitoring service will find potential fraud and wasteful spending for you. This includes expenses across all card types and payment methods. Our tools are customizable and tailored to your specific card policy in order for you to receive accurate expense reports each month.

For More Tips, Download the Complete T&E Best Practices eGuide

Card Integrity’s travel and entertainment card expense review best practices eGuide will provide your organization with a clear and detailed outline of the most important practices that can be implemented into your T&E program today.