During the COVID-19 pandemic, organizations have had to adjust to highly unusual times and circumstances. This has been particularly true in how the coronavirus has played a role in changing business expense trends.

It should come as no shock that, in a 2020 report regarding commercial card use during COVID-19, RPMG Research Corporation noted that 60 percent of those who responded to their survey reported a change in spending patterns during the pandemic.

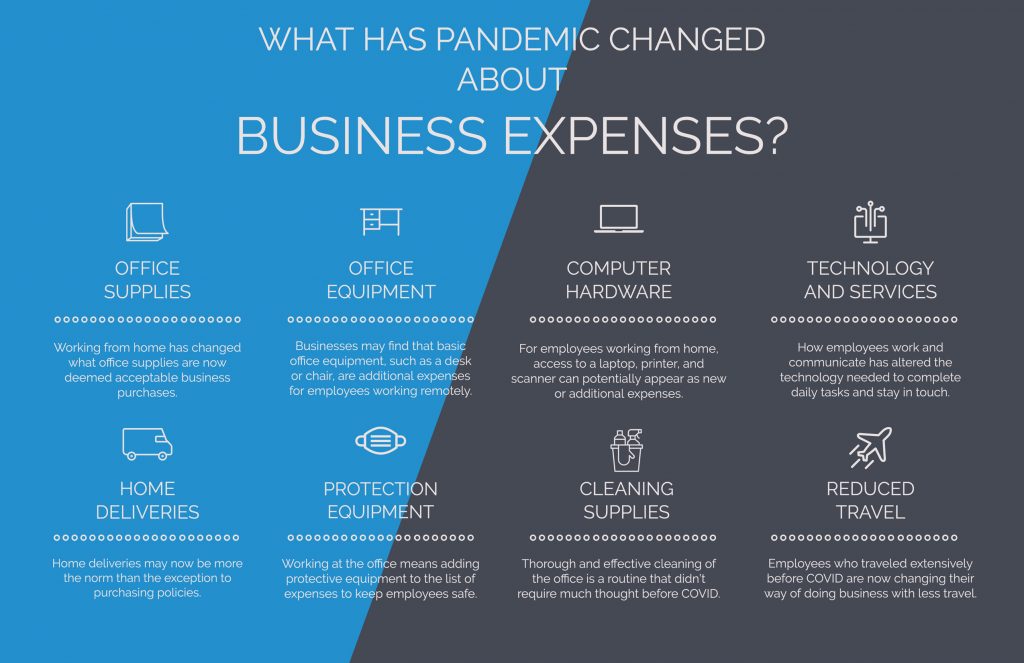

Elements such as changes in production and work-at-home orders have created new expenses, as well as the need to look differently at old expenses. So it’s important to know where these changes are tending to occur and to address them appropriately, with the current times in mind.

Differentiating good spend from bad during COVID-19

The pandemic has turned businesses and their spend systems upside down. Expenses that might have once been red flags before the pandemic could now be quite legitimate. And the reverse is true as well. Expenses that might have been perfectly normal pre-COVID should be raising eyebrows within the light of the pandemic.

So the pandemic demands a whole new look at your expense program. In fact, that rehab is going to require not only a fresh look at your expenses, but also the policies and procedures that dictate how your program runs.

Determining your new expense environment

To understand better what expenses are right from wrong, you’ll need to reexamine how you now do business. Ask yourself these questions about how you are now doing business and how it differs from pre-COVID times:

Are your employees working from home?

If so, what expenses might they now be incurring on their own? These could be, in part:

- Office supplies (such as paper, printer ink, pencils, pens, and sticky notes)

- Office equipment (such as a chair and a desk)

- Computer software (which might include both SaaS [software as a service] platforms, on the web or stand-alone programs)

- Computer hardware (such as laptops, printers, scanners, and external hard drives)

You’ll need to determine what you will be supplying your work-from-home employees and what you expect your employees to purchase on their own. Those decisions then will need to be communicated via updated policies.

Are your employees continuing to work on-site?

COVID is affecting business in every way possible. If your employees are working on-site, you might have found that you are now in need of office equipment and supplies that you’ve never needed before, or if you did, in quantities like never before. Not only do you have to come up with systems for keeping your employees safe, you have to pay for those systems. New categories and new allotments regarding budget will probably be necessary.

Are your employees traveling on business right now?

If not, any expenses on travel cards or for travel/entertainment purposes should raise huge red flags upon receipt reviews. Why is an employee working exclusively from home submitting restaurant receipts or hotel bills? While those might have been regular expenses for this particular employee previously, due to COVID, they would no longer be valid.

Specific expenses to examine

When answering these questions, you’ll want to look at some very specific expenses that could either be more valid or less valid than they were before the pandemic, to discern if something has changed.

Expenses to consider if your employees now work from home

Office needs. As mentioned above, if an employee now works at home, anything that was once necessary in the office is now necessary in his or her home. How will they get the supplies or equipment that they need? Who will pay for it? In the past, such expenses for an employee’s home might have been a problem, as they would have been viewed as personal items. Now, however, when tracking such expenses, it’s important to realize that these purchases for the home could be legitimately for business purposes.

Home deliveries. In some cases, the way those supplies and equipment is going to make it to the employee’s home is via delivery. That, of course, is a further expense. You’ll need to determine if your business will approve such expenses, and then watch for them accordingly.

Informational technology. Home computer equipment breaks down just as office equipment does. It’s important to remember that business-related IT within the home might now be a necessary expense. You’ll need to determine particulars, such as requiring approval beforehand and selecting vendors to supply the IT services.

Expenses to consider if your employees work on site

Protection equipment and supplies. Once upon a time, you never would have thought that you’d need plexiglass to separate your employees who work in close proximity. And yet, the day has come. Dividers, gloves, masks, signs — all have become necessary in light of COVID-19.

Cleaning equipment and supplies. Who knew that sanitizer on everyone’s desk would become a thing? Or that you’d be washing down office equipment and furniture constantly? But now that it has, you’ll need to recognize why these supplies are being purchased and large quantities that might now be involved. Perhaps you’ll even need to decide where these supplies are coming from, in order to feel good about both quality and price.

Expense changes to consider if your employees no longer travel

If travel has become greatly reduced in your organization, it’s important that your expenses reflect that. If your program was once lackadaisical regarding T&E expenses, especially from employees, such as salespeople, who racked up big — albeit legitimate — bills, such disregard can no longer continue. See the next section regarding steps to take in regards to preventing unwarranted travel spend.

Specific methods to examine

Similarly, you’ll want to consider how employees are paying for things. If you’ve had separate purchasing cards (P-Cards) for different spend categories, you might find that your employees just don’t need some of them anymore.

Take, for example, a travel card. If your travel has gone down to zero, it might make a lot of sense to temporarily suspend those accounts, so that no one could misuse or abuse them.

Likewise, you might decide that employees who never had or used P-Cards in the past now do need them. They could make life much easier for both the employee who now needs to buy their own office supplies, as well as for AP and department heads. The cards, by their very nature and purpose, can help organize data that can be more easily monitored, tracked, and reviewed, than invoices alone might be.

Solutions that make discerning expenses during COVID-19 easier

Card Integrity offers a number of services that can help make this time of differentiating expenses and discerning polices changes much easier.

Our staff has the expertise to help you decipher and develop any necessary new policies and procedures that better reflect your business as it now stands, due to the pandemic.

Through our Training-Wise services, we can ensure that your employees and managers are all brought up-to-date on the newest spend allowances and how they are to be handled. All new policies and procedures will be communicated, and evidence of receiving the information will be secured.

Thanks to our online training system, it doesn’t matter where your employees currently work. Whether they are home or at your place of business, or even if they are on the road, our training reaches your staff in a convenient and efficient way.

Our Data-Wise solution completely handles monitoring of your expense program, releasing your management — already bogged down with additional COVID-related responsibilities — from the additional burden of overseeing new and unfamiliar spend data and trends.

And to help organize and categorize all the new receipts pouring through your system as everyone works now from home, look to our Receipt-Wise services. We review and organize your receipts, so your managers get a clear view of where your money is being spent during the pandemic.

No matter your industry, Card Integrity has a solution that’s just right for your expense program. If you’d like to learn more about any of our services that can keep your system working well, despite the uncertainty of COVID-19, call us today at 630-501-1507, or contact us through our online form.