If you’ve spent any amount of time in purchasing, procurement, sourcing, or finance, you’re likely to be well acquainted with rebates. And even if not, most everyone who has ever owned a credit card is familiar with the concept. A rebate is an incentive that credit card providers offer, usually in the form of a percentage spent on the card paid back to the entity that is responsible for purchases on the card. For your personal cards, that’s you. But in the context of company credit cards, this means that a fixed percentage of the organization’s entire credit card spend, if certain thresholds are met, are paid back to the organization.

This blog post will discuss company credit cards specifically. By this, we mean credit cards which are awarded to employees to conduct purchases which are necessary for their job. These cards are often called by different names depending on the organization and what specifically it’s used for. At your organization, these credit cards may be called P-Cards, travel cards, OneCard, ProCards, corporate cards, among other names. These all fall under the umbrella of what we mean by a “company credit card”.

We find that a common rebate percentage is about 1.5%, though higher and lower rebate percentages are not uncommon. But for the purposes of this blog post, 1.5% is a good estimate. No matter what your monthly spend is—and our readers range from tens of thousands in monthly spend to tens of millions—it’s worth benchmarking and setting goals for your organization as it relates to rebates.

Now, of course, you can’t just say, “put it all on the card”. Policies exist for a reason, and there are several things that you simply can’t put on corporate cards for a variety of reasons. That’s why it’s important to look at this issue judiciously and target certain areas of your organization’s spend.

Targeting Out-of-Pocket Expenses

Some of the best avenues for spend that can be moved over to credit card are out-of-pocket expenses. By out-of-pocket expenses, we mean spend that employees at your organization pay for themselves. For example, if your marketing team is going to a trade show or a conference, paying for their meals and travel out-of-pocket (either with cash or their own personal credit card), and then reporting this spend, perhaps by uploading images of their receipt into your ERP system and being reimbursed for it later with a check, this would be an example of the type of spend that we’re talking about. Out-of-pocket expenses, in addition to not contributing to potential rebate, have several other disadvantages when compared with corporate card spend:

- They involve a high level of manual data entry

- There is a high susceptibility to error

- They cost more to the organization

- Data entry responsibility lies with the employee

Cardholders are generally not excited to put together expense reports for their out-of-pocket transactions. It’s not what they are hired for, and we can expect that the attention to detail may not be perfect. This leads to a lot of potential mistakes, which in turn leads to wasteful spending. For all of these reasons, out-of-pocket spend makes a great candidate to turn your attention to when considering where to shift spend to credit card to increase rebate.

Targeting Invoice Transactions

You may also consider moving some of your organization’s invoice transactions to credit card. If you look at a stratified report of your organization’s invoice data, the picture starts to become more clear as to how and why these transactions may be a good candidate. Your specific data may vary of course, but we’ve found that the average invoice transaction amount at most organizations is significantly higher than the median invoice transaction amount.

If it’s been a while since you’ve thought about the difference between average and median, we’ll explain it quickly. An average is the sum of all values of a data set divided by the number of values. So, if we have five invoices with the following values: $100, $100, $200, $1000, $2000, we add them up and divide by five, giving us a value of $680 as the average. The median of this data set is going to be quite a bit different, though. A median is the “middle value” when a data set is ordered from least to greatest. So, in that same example: $100, $100, $200, $1000, $2000, the median is the third value of the five: $200.

When the average and median of a data set differ like this, it tells us that the distribution is skewed. In the example above, the median is significantly lower than the average. This means that there are a large distribution of smaller invoice transactions within the data.

If the average and median of your organization’s invoice transactions looks something like this, as it does for many organizations, you’re paying a lot of smaller transactions via invoice. Why not get some of those smaller transactions onto credit card instead?

Invoices Are Expensive

The internal cost of invoicing varies based on a variety of factors. Based on figures from industry reports done by organizations like CAPS Research and APQC, the average cost of processing a purchase order through to vendor payment can range from $50 to more than $1000 in extreme cases, depending on the industry, and the complexity and efficiency of the procurement and payment processes. Whenever the internal cost of invoicing is greater than the service charge of putting the transaction on credit card minus the rebate back, it makes more sense to put the transaction on a company credit card versus manually invoicing it. There exists an equation for every organization to find what that number is.

That calculation, again, is going to be different for every organization. What exactly is your internal cost of invoicing? And what is your service charge percentage? And your rebate percentage? Those variables, depending on their value, will output a dollar amount that can serve as a guideline for when to manually invoice versus put the transaction on a credit card. That “break even” dollar amount can even be implemented into your policy: all transactions higher than it should be invoiced, and all transactions lower than it should be put on the credit card.

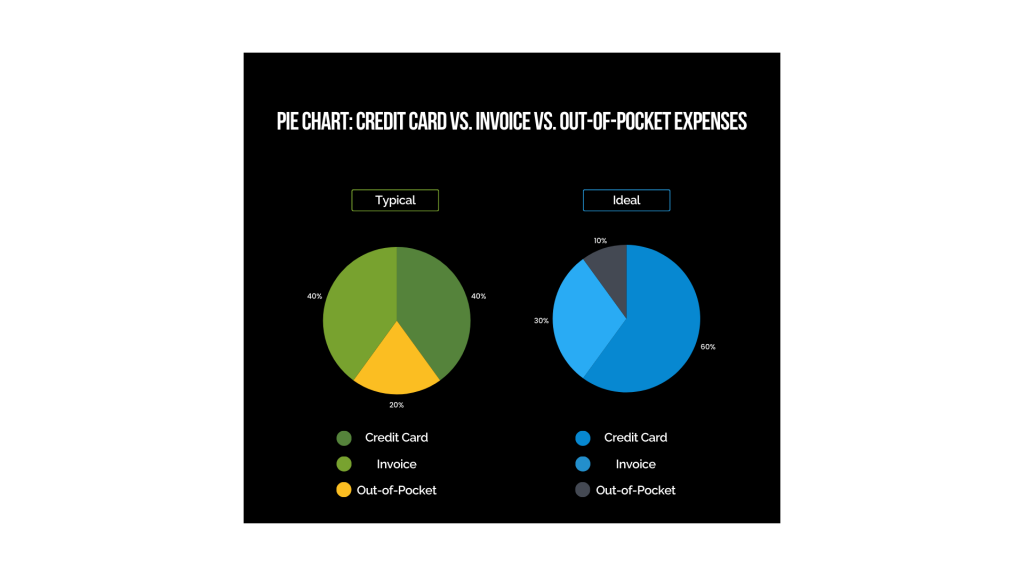

Take a look at the two pie charts below. On the left, you can see a typical distribution of an organization’s credit card versus invoice versus out-of-pocket expenses. On the right, you can see what would be a more idealized distribution that maximizes rebate. Your company’s distribution may look different. Ideally moving from one distribution to the other would be done through the number of transactions, not the number of dollars spent. The point is that the actual spend itself is not increased by this transition, otherwise, what would be the point of the rebate? It would be canceled out by the extra money you’re spending anyway.

At Card Integrity, we offer reports that can help you visualize this idea. We also explore this idea further in the webinar below.

Let Us Do the Work

Card Integrity’s expense monitoring service includes a rebate report and a P2P (procure-to-pay) optimization report that does this for you. We can take a holistic look at your organization’s data and help you benchmark to hit your rebate goals. If you’d like to see the reports in action, you’re in luck! We recorded a webinar where we discussed this topic in depth and walk through these reports. You can view the recording below!