Every system has its pros and cons. This is especially true when it comes to purchasing cards (known commonly as P-Cards, but also including other terms depending what the card is used for, like corporate cards, ProCards, OneCard, travel cards, and more). Negative things can happen when a company tries to implement them that often overshadow the positive.

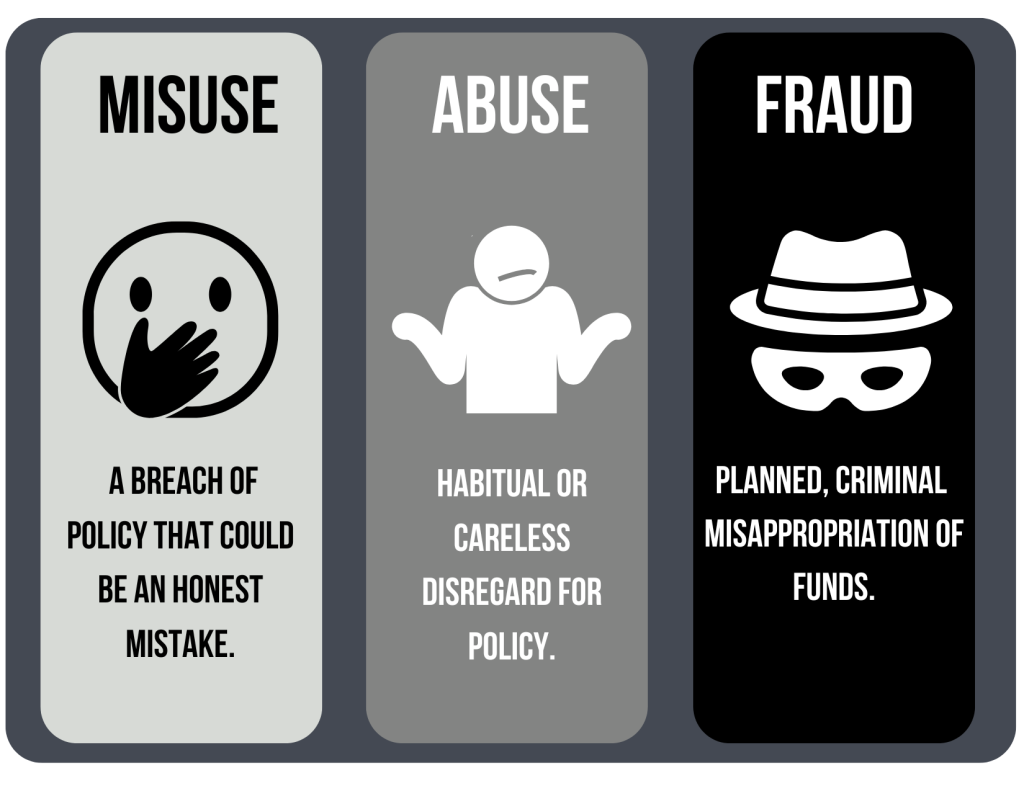

As such, you’re sure to hear and read words such as “fraud,” “misuse,” and “abuse” used in conjunction with P-Card programs. But while these three words all convey an incorrect usage of P-Cards, they are not the same.

So just what makes fraud, misuse, and abuse different in terms of P-Card usage?

Fraud: Purposeful deceit

According to Merriam-Webster, the act of fraud is an “intentional perversion of the truth” and “an act of deceiving”: in short, intentional deceit. There is full knowledge on the part of the perpetrator that what he or she is doing is dishonest, in an attempt to deceive or trick someone else, in order to gain access to what that person desires.

Fraud, also commonly called embezzlement, is purposeful, and of course, criminal.

Example of fraud

Unfortunately, there are countless examples across higher education, public, and corporate spaces. A recent, high-profile case involved the NFL’s Jacksonville Jaguars in which an employee embezzled $22 million from the team over a course of four years. He attempted to cover his tracks by duplicating transactions, inflating legitimate transactions, and creating fake transactions that never occurred. He used the money to fund a lavish lifestyle and was eventually sentenced to over six years in federal prison. The fraud scheme is further detailed by the District Attorney’s Office article included in this paragraph.

This story made headlines beyond just the sports media sphere due to the amount of money stolen. But similar stories are very easy to find, and the embezzled money is often hoodwinked from public institutions like cities and counties, so it’s taxpayer money being stolen in those cases. On top of the legal and financial turmoil, it creates a PR nightmare for any organization it happens to.

Misuse: Incorrect ignorance

The difference between misuse and fraud is simple: misuse implies a lack of intent.

In the case of misuse, a P-Card user has purchased something with the card that was surely “inappropriate.” There’s no question about the use itself being “wrong” or “incorrect.” Instead, the questions are: Did this person know how to use the card correctly in the first place? Did the user know that he or she was purchasing something outside of the company’s policies and procedures? Or, were there extenuating circumstances that led the user to not know — such as a lack of adequate training or communication?

If a user has limited knowledge on how to use a P-Card correctly and then goes on to use the card incorrectly — that is misuse. The user never intended to use the card inappropriately. There was no intent to deceive. Rather, the user just didn’t know. It then becomes difficult to point a finger of blame and fault at a user who, acting purely out of ignorance, uses a P-Card in a way inconsistent with company policies and procedures.

Example of misuse

Maybe an employee at a large resort has been tasked to purchase a new lawnmower for the maintenance of a golf course on the site. The employee goes to Home Depot with her P-Card to accomplish this. She finds that the model her boss wants is over the price limit for a purchase on the card. She figures, “no problem, I’ll split it up into two. That’s how I get around that on my personal card. And my boss wanted me to buy it, so why does it matter?” Of course, the corporate entity who owns the resort has policies, and one of them is that split transactions like this are not allowed. The employee has misused her P-Card, and maybe her boss has some blame in it too. Is it a fireable offense? Probably not. If it was explained to her, would she do it again? Probably not. But those policies are in place for a reason.

Misuse cases are often one-time events like this: honest mistakes born by unfamiliarity or ignorance of policy.

Abuse: A bad practice

Abuse is improper P-Card use that is knowledgeable, excessive, and habitual — but not necessarily deceitful.

For example, an employee fully knows that the company P-Card is not supposed to be used on personal items such as groceries. This person knows buying groceries with the P-Card is wrong, yet uses the P-Card to grocery shop anyway — and at least for the time being, is getting away with such use.

The user isn’t trying to deceive or trick anyone. The employee is spending in plain view. The receipts from the purchases tell the tale. And as time goes by, typically without reprimand, grocery shopping with the P-Card becomes a habit for this person.

Such use of the P-Card stands out as a bad act, to be sure, that eventually turns into a bad practice.

Example of abuse

An example of abuse can happen when a well-loved employee at an organization retires, and the person responsible for throwing their party pays for alcohol with his P-Card. He knows it’s technically against policy, but… eh, who’s really looking? Dave gave so much to the company, after all.

Well, a responsible procurement department is. And paying for alcohol, especially for a non-work event, is a brash example of P-Card abuse. The organization should not be paying for an open bar at Dave’s retirement party, no matter how much everyone likes him.

Another example of abuse is repeated offense. Let’s say an employee knows that it’s company policy to procure goods from Home Depot due to a contract, but he goes to Lowe’s instead because it’s closer to his house. Doing this once is maybe an honest mistake. Multiple times, it gets into abuse territory.

What keeps fraud, misuse and abuse at bay and in check?

How can you stop and even prevent the risk of loss from P-Card fraud, misuse, and abuse? An internal audit helps identify those committing fraud in their P-Card system. Such audits and reviews of purchases play a key part in reducing risk in a P-Card program. Staying on top of purchases as they occur isn’t easy, but it is necessary. And a great way to do that without a strain on your internal management is Card Integrity’s DataWISE expense monitoring solution.

DataWISE reviews and validates your company’s P-Card receipts on a regular monthly basis — helping to reveal non-compliant behavior and any suspected fraud.

Using DataWISE means a significant savings in both internal reviewing and the reduction of fraud. And when audits are performed, they move more efficiently and deliver results more effectively.

Cardholder training is also an effective way of combatting misuse within an organization. Card Integrity also offers online cardholder training, called TrainingWISE, to facilitate mindful purchasing habits.

To learn more about DataWISE, other comprehensive services, or how your company can reduce fraud, misuse, and abuse, download our free P-Card Best Practices eGuide below. It’s full of tips on all things P-Card, including:

- P-Card policy

- Audit

- Management

- Infrastructure

- Submission guidelines

- Purchasing

- Training

- And more!